I bet you can offer a couple of decent reasons why you have money in the financial markets.

I explain to my clients that the purpose for their portfolio is simple: It is designed to protect the purchasing power of their saved dollars for some point in the future. If you are a long term investor, I imagine your answer would be fairly similar to mine.

What if you looked at this from another angle. What if you were asked for the reasons why you don’t invest? I am not asking for the reasons why you keep money out of the market. Instead, I am asking you to think about the results you should not expect to come from investing.

One important reason not to invest is because you believe that your investments will immediately begin appreciating starting from the moment you bought them. Although the possibility exists for this to be the case for a period of time, it should in no way be expected. Keeping a short term perspective and anchoring yourself to the date you purchased investments or initiated a financial plan will inevitably lead to disappointment. The problem is that for most people they intuitively believe this to be the way investing works.

Like everything else about investing with a long time horizon, having the discipline to accept this concept is very difficult. Especially lately. If you invested in a globally diversified asset allocation strategy that doesn’t seriously overweight the S&P within the past several years, you may be considering something that would help prove a really unfortunate statistic: the average holding period for a mutual fund in the US is only 3.3 years. I have never seen a long term investment plan with a 3.3 year time horizon.

For your long term investment plan to work, you must begin understanding the right reasons you invest.

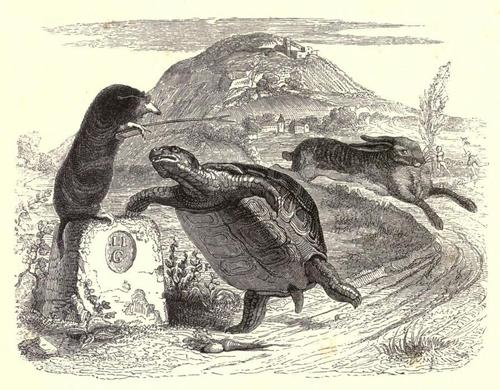

image: “Grandville tortoise” by Jean Grandville – Licensed under Public Domain via Wikimedia Commons