Whatever is happening in the world right now may cause your retirement account’s value to fluctuate some, but will not likely impact your long term plan. That is, unless you decide to behave poorly

and “get out of the way until this / it passes”.

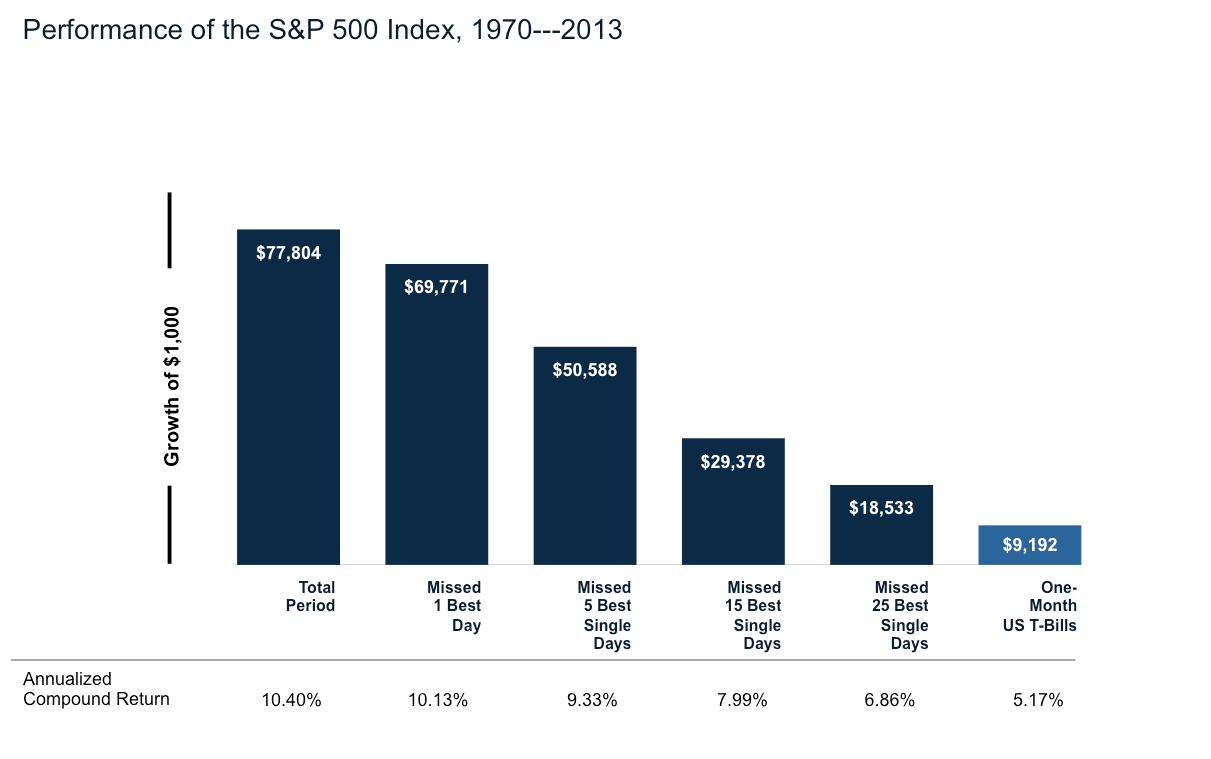

Dimensional Funds puts out some truly fantastic research, they really nail this point here:

From 1970 to 2013 the S&P compounded at 10.40%, not bad. However, had you missed the single best trading day over that time frame you found yourself earning slightly less at 10.13%. At first glance that may not seem like much. That is of course until you realize you are talking about 1 day over the course of 43 years having a measurable impact on the outcome. What if you missed the 5 best days? 9.33% The top 25? Well you would have earned 6.86%, which is only slightly higher than what One-Month T-Bills did over the same time period: 5.17%

We simply do not have the ability to know when the best days are going to be, no one does.

Here are a few factors that actually do matter:

Awareness of what long-term actually means

According to a study done by Dalbar, the average holding period for a mutual fund in the US is 3 years. This tells me that most people have an unfortunately limited grasp on the concept of long-term.

Having a strong belief in what you are investing In

Are you making an investment, or just buying something? If it’s the latter, you should probably rethink your decision. Having a strong belief in what you own will go a long way towards helping keeping your behavior in check.

Being diversified

Do you own a well thought out variety of asset classes in appropriate weightings? Aside from potentially adding significant returns over time, diversification will really help to mitigate the effects of volatility fatigue on your psyche.

Managing your behavior

If you think sticking to a plan created during a bull market is going to be easy when the tides turn, you’re either a stoic or have never experienced a rough patch. Like Michael Batnick always says – “Investing is simple, it’s just really hard to do.” Success depends on how well our behavioral tendencies are managed. A good advisor will go a long way with this one.