Instantly accessible information has made seriously cynical consumers out of us all of us. Using our surgically connected devices, everything gets checked out. At this point, basic purchases require a forensic audit of every mention the item or service has ever had long before we are ready to commit.

Bottom line, multiple well-vetted citations are needed prior to our confidence being won over. One review on Yelp or Amazon won’t do. We require more sources than tough-grading graduate level professor in order to complete our narrative.

Try this as an experiment: Google the term “best toothbrush”. It likely won’t be your first inane attempt to conclude what the “best” product is. It wasn’t even my first time looking into the nuance of oral hygiene technology. Best part? The search yielded nearly twenty million results.

Let’s take it a step further and exchange topics from the pre-purchase research of low-end consumer goods to more costly items, like professional services. Specifically those who make a living playing the role of expert and dispense advice for a fee.

When was the last time someone’s opinion, or advice about anything meaningful to you went un-googled? I bet you can’t even remember. And why not? With a few key strokes we can drop our bucket into a bottomless well of information using a device that is likely no more than three feet from you right now. And come on, what feels better than debunking someone’s BS? Not much.

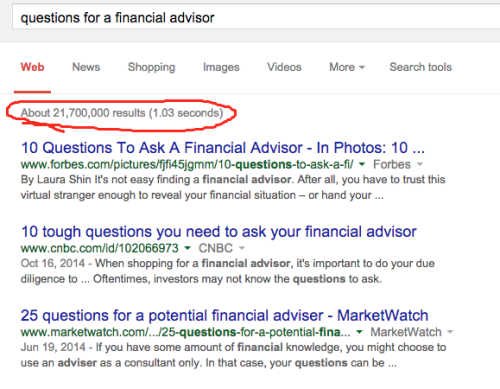

So I searched for another phrase. I swapped “best toothbrush” for “questions for a financial advisor”, this time I got almost twenty-three million hits.

There were literally dozens of “Top Questions to Ask a Financial Advisor” posts and articles ready to annihilate any chances you had of feeling confident before or after talking with a potential advisor.

I personally attribute this demand for answers to two key factors: a deservedly high level of public distrust for the financial services industry and a lack of institutionalized financial education. Students spend more time learning about a plant’s cell walls in school than they do figuring out how to balance a checkbook, never mind understanding the basics of investing.

As a result of these mistakes, many of us end up starting off relationships with financial professionals on pretty bad footing.

I spend a great deal of time talking with interested potential clients here at our firm. I am fortunate because most of the people coming to us have been reading my partnersJosh Brown, Barry Ritholtz, or Michael Batnick for a decent amount of time, sometimes years. This results in a relatively high level of financial literacy, contrasted with someone coming to a typical firm based on a game of golf and a steak dinner. This wasn’t always the case for me; I spent the first 5 of my nearly 8 years as a financial advisor in a major wirehouse brokerage firm. In the wirehouse, golf and steak overwhelmingly trump reading as the primary motivator for purchasing services

Consumers are basically adrift on an ever expanding, (mostly) un-curated ocean of noise. Someone desperately afraid of running out of money in retirement ends up justifiably bewildered. It is difficult to decipher signal from noise when there is so little trust, and so much noise.

In my opinion, there are the 3 characteristics good financial advice should contain:

- It should be given by someone you like who is qualified to be giving advice. This may seem so elementary, but it’s absolutely worth noting. Financial success is not typically something that happens in short periods of time. Most times it requires long stretches of behavioral adjustment. Therefore, the giver of advice is likely someone you will want to develop a relationship with. Relationships without chemistry are not usually very successful for any useful period of time. They should also be qualified to be giving the advice. A great place to dig into their background is brightscope.com. You can see their work history, and whether or not it contains any disciplinary actions or misdeeds along their path.

- It should only be given after arriving at a conclusion based on an exploration into your needs. Taking off the cuff financial advice should be avoided at most costs. If it is simply a fact or specific rule that applies to anyone – like IRA contribution limits at a certain age / income level, that’s fair. But if it has to do with how you should be allocating assets, how much you should be saving, what types of accounts you should have – these are all things that require developing a far deeper understanding than a brief conversation can offer.

- It should be simple for both the receiver and giver to understand. If the person giving the advice has your better interest in mind, they will have a deep grasp whatever it is they are recommending you do or invest in. If they truly do, it will be conveyed with ease. It may require some detective work on your part, but it shouldn’t be too difficult to figure out if you are listening to someone who doesn’t deeply understand the stuff they are talking about.

I am probably leaving a few good ones out, but following these three would be a fantastic place to start. Like so much else in life, good financial advice is supposed to be simple.